The turbulent year of 2024 is over and despite all the adversities, such as the ongoing crises in Ukraine and Israel, the markets generally recorded gains. At the turn of the year there was still a positive development, the dictatorial Assad regime in Syria was supported, but only time will tell whether the successor will really introduce a democracy or whether there will be another totalitarian Islamic state. At the moment the development looks very positive. On January 20th there will be another high point, the inauguration of Donald Trump, then the world will also see what his final government team looks like and be able to estimate where the journey is going.

As already briefly mentioned, the markets have moved upwards over the year 2024, only in the last few trading days there were some declines. The S&P500 gained more than 25%.

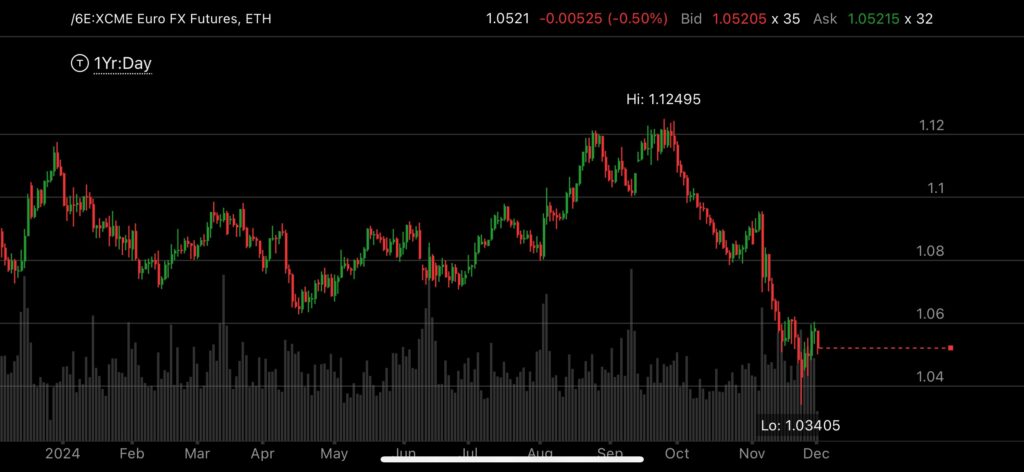

The fact that the European economy is weakening is also clearly shown by the euro exchange rate, one can only hope that a recovery will soon emerge, although the new election in Germany does not necessarily contribute to this.

Our focus for 2025 will continue to be on economic development and of course on geopolitical conflicts, but we still assume that 2025 will also end on a positive note and we can only hope that it will not be quite as turbulent as 2024.

We wish all our readers a successful new year!