There is still no solution to the Ukraine issue. Those who had hoped for a steady path to peace after the meeting between Putin and Trump in Alaska and the subsequent meeting with the head of Ukraine and EU leaders were disappointed. Currently, the war continues in full force. The EU is talking about security troops after the war, and Putin is threatening that this should actually happen. A quick end is once again far from the horizon. There are no signs of easing tensions in Gaza either. Israel’s decision to completely occupy Gaza City, no matter the cost, is not met with universal approval. One gets the feeling that Israel wants to end this conflict once and for all with force.

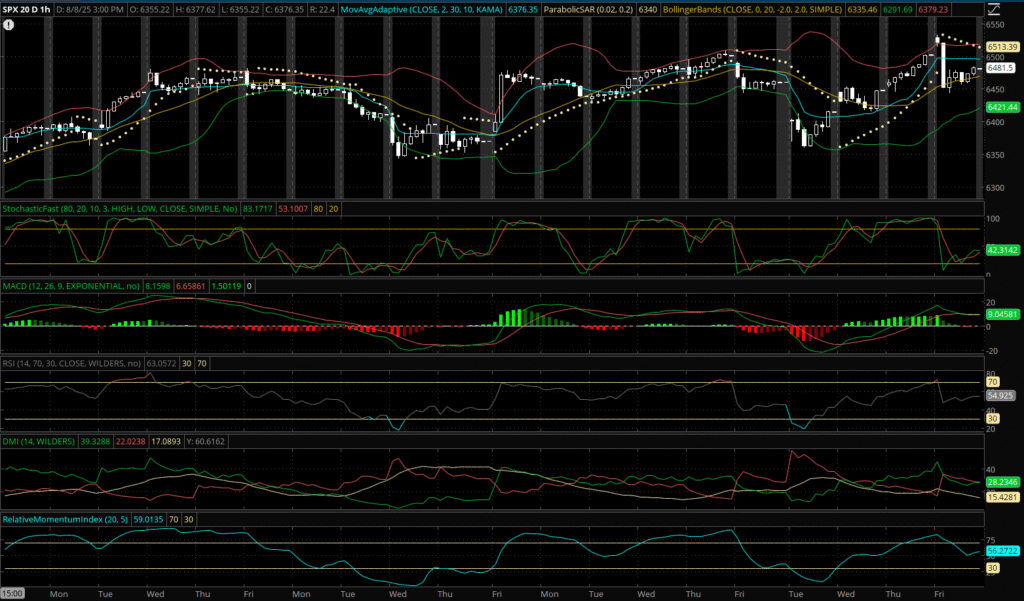

The markets, however, are reacting more to the power struggle between the Fed and Trump and to the economic data itself. The new tariffs have had no impact yet, but the worst is likely yet to come. The markets are definitely nervous and volatile.

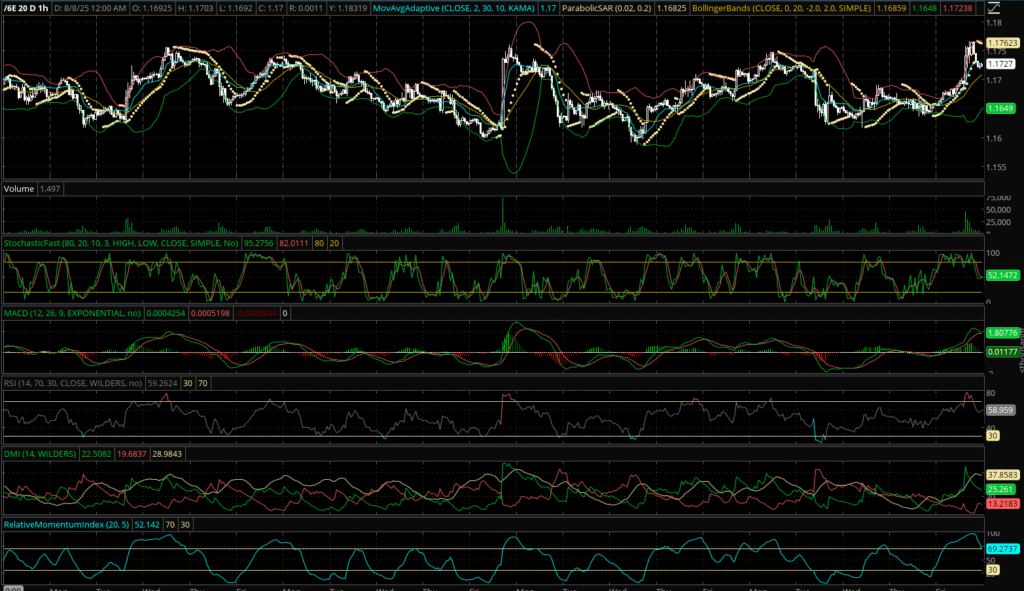

The Euro/USD is also subject to strong fluctuations, depending on the progress of Ukraine policy and tariffs.

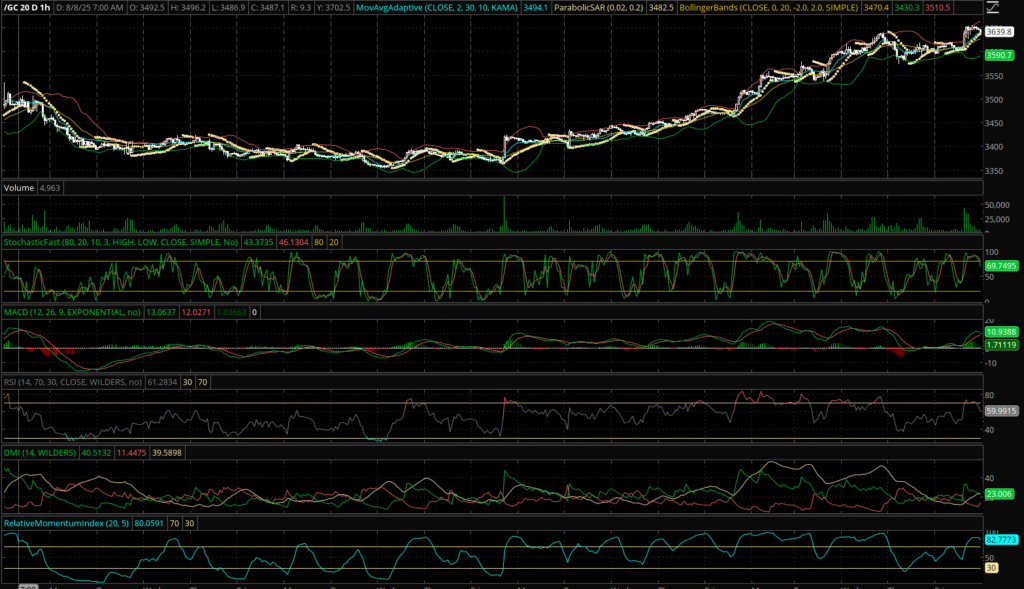

The only consistent safe haven is, once again, gold.

For professionals, it is naturally an exciting and often very profitable time. We always try to find and exploit the best situations.