A lot has happened again in our world. If the situation in Ukraine and the escalation in the Gaza Strip aren’t enough, no, now there’s an open conflict with Iran. Let’s hope that all parties will soon sit down at the table and start talking sensibly again. Trump continues to fly like a flag in the wind, changing direction almost hourly. Predicting what he’s planning or intending to do next is therefore a virtually impossible task. The markets have taken this almost calmly, and investors are focusing more on fundamental and economic data, ignoring the roar from the White House. On the other hand, of course, all of these actions are having an impact on the economy. Time and again, we hear that the US could slide into a recession, and with higher prices to boot. Let’s hope that the Fed counteracts this, so nothing can be expected from the government in this regard. Trump’s budget proposal was waved through the Senate once, but it remains to be seen whether it will do the same in the House of Representatives. As already mentioned, the markets remain unfazed at the moment and continue their positive trend.

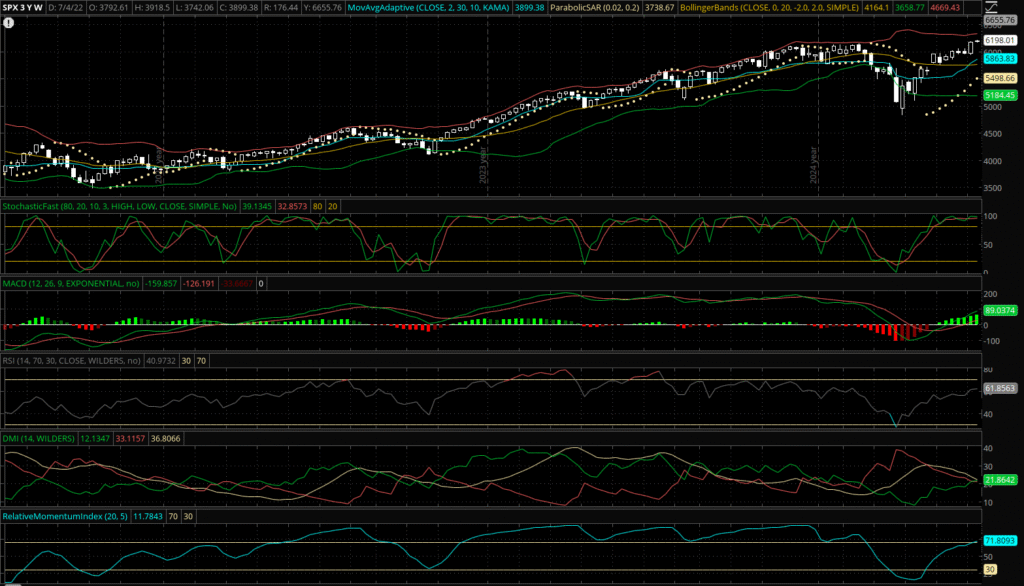

S&P 500

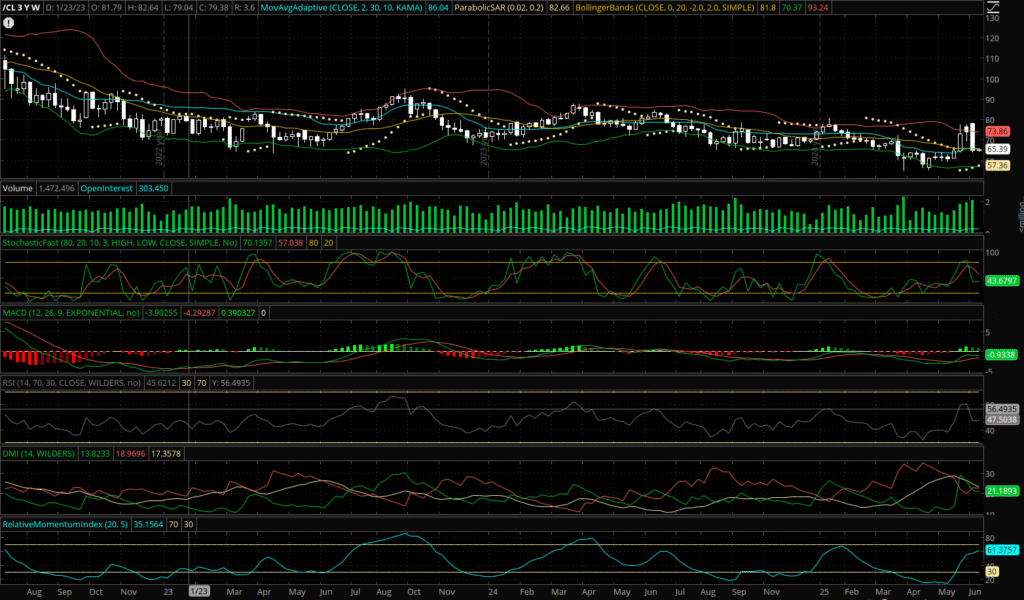

Oil remained relatively unaffected by the entire Iranian turmoil and continues to hover around $70.

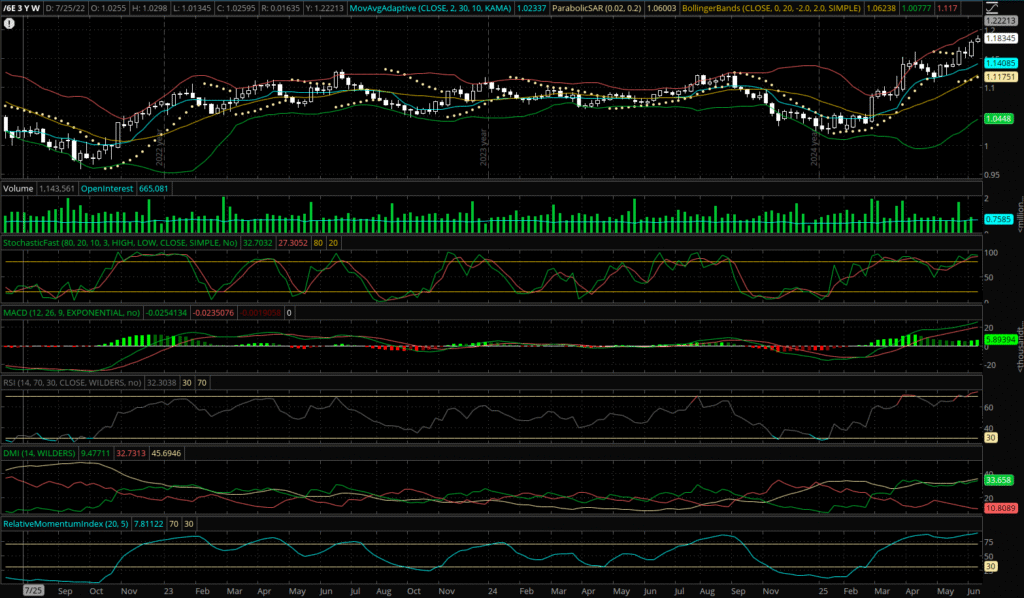

However, the euro benefited significantly from Trump’s policies, gaining significantly against the dollar.

Our strategies also helped us achieve very good profits in the second quarter. The combination of stocks and futures was able to cushion all adverse effects.