The year is barely two weeks old, yet it will already go down in history. Trump’s attack on Venezuela and his ambitions regarding Greenland are throwing world politics into turmoil. Even at home, there is growing rebellion against the president and his methods. As has often been observed, he apparently suffers from attention deficit disorder. He quickly loses interest in issues if they aren’t resolved quickly to his satisfaction, as seen with Ukraine. The bombing continues, and peace seems a distant prospect.

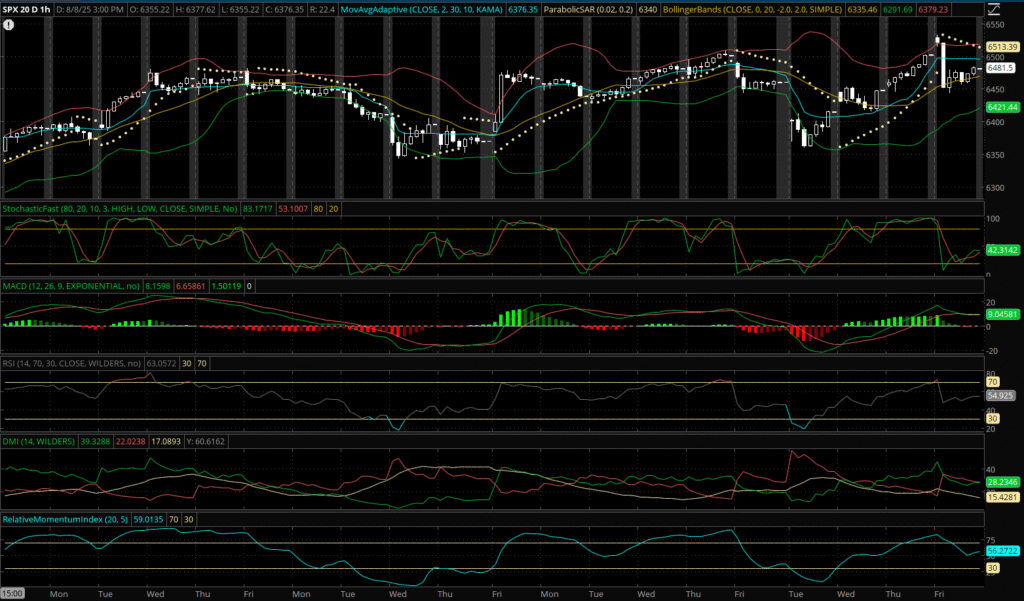

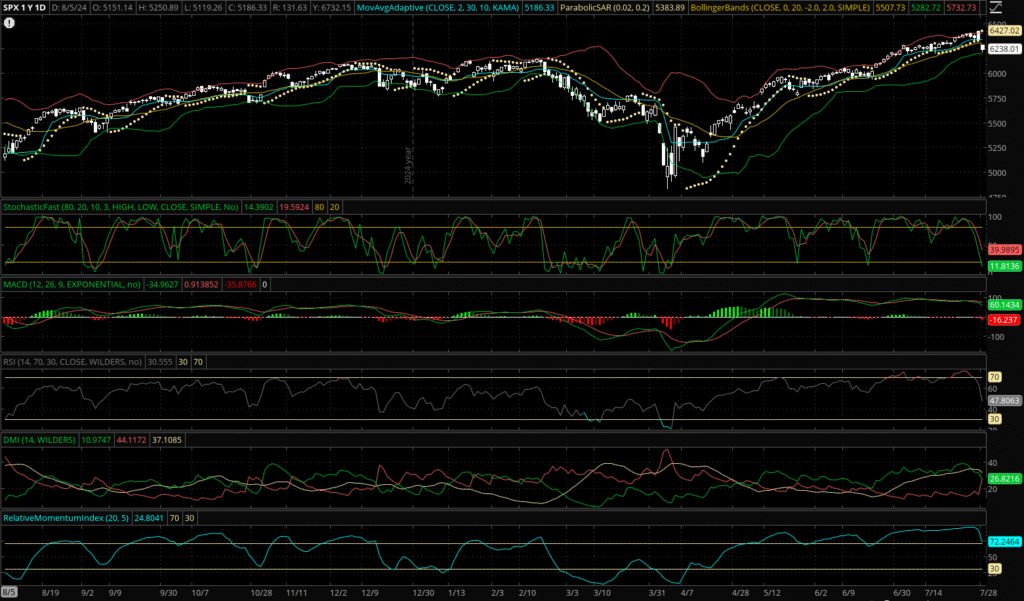

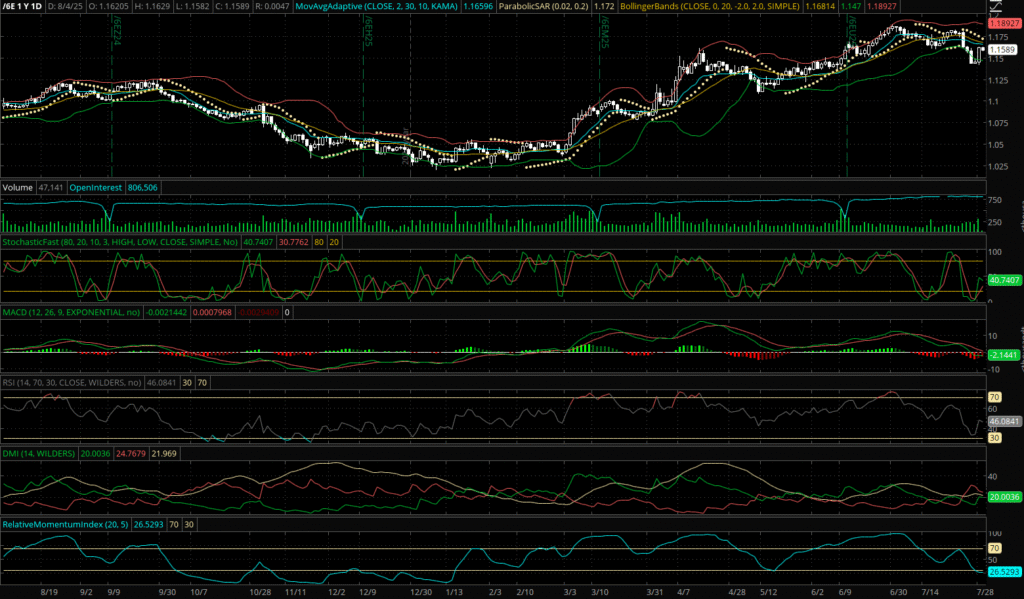

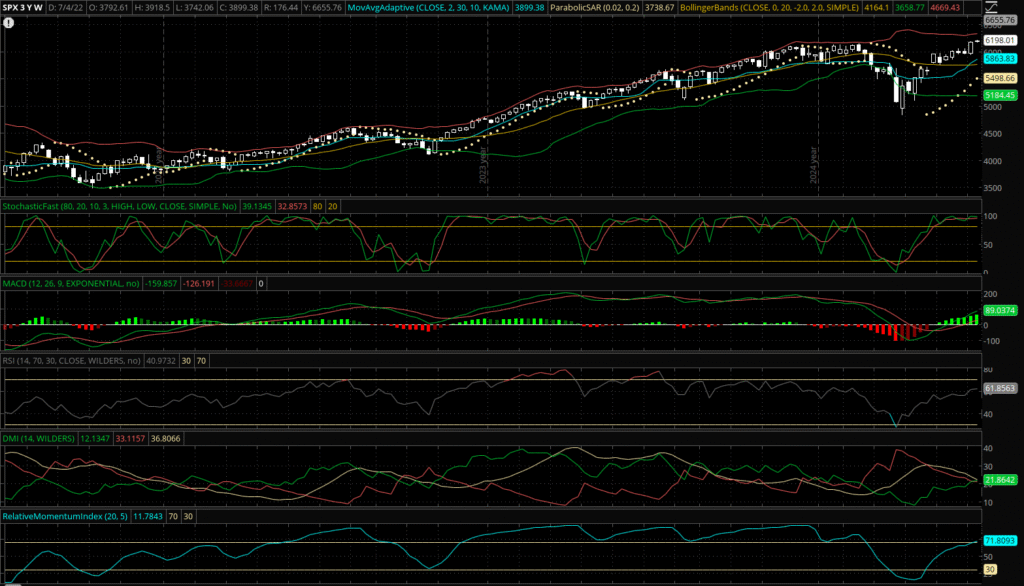

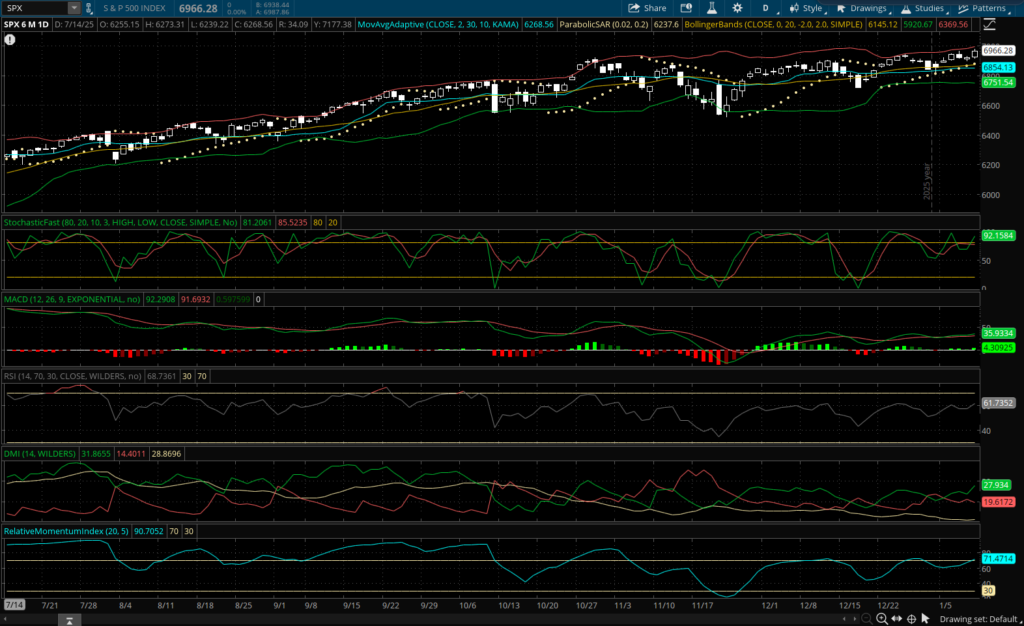

The markets are actually reacting very little; we’re in a volatile sideways movement, much like a tiger waiting intently for its prey, poised to pounce. But even here, Trump wants to exert influence by launching an investigation against Federal Reserve Chairman Jerome Powell.

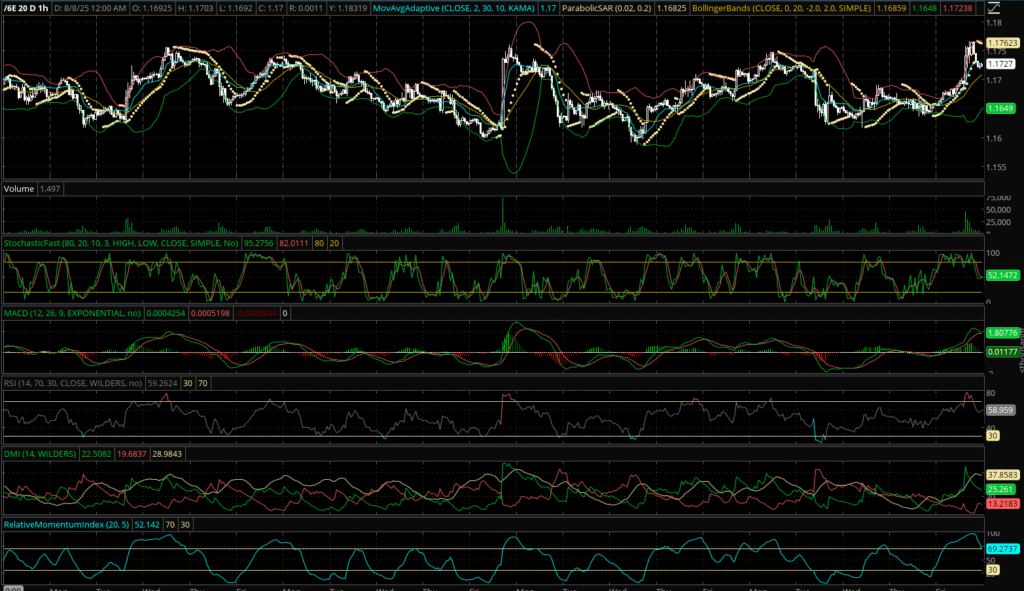

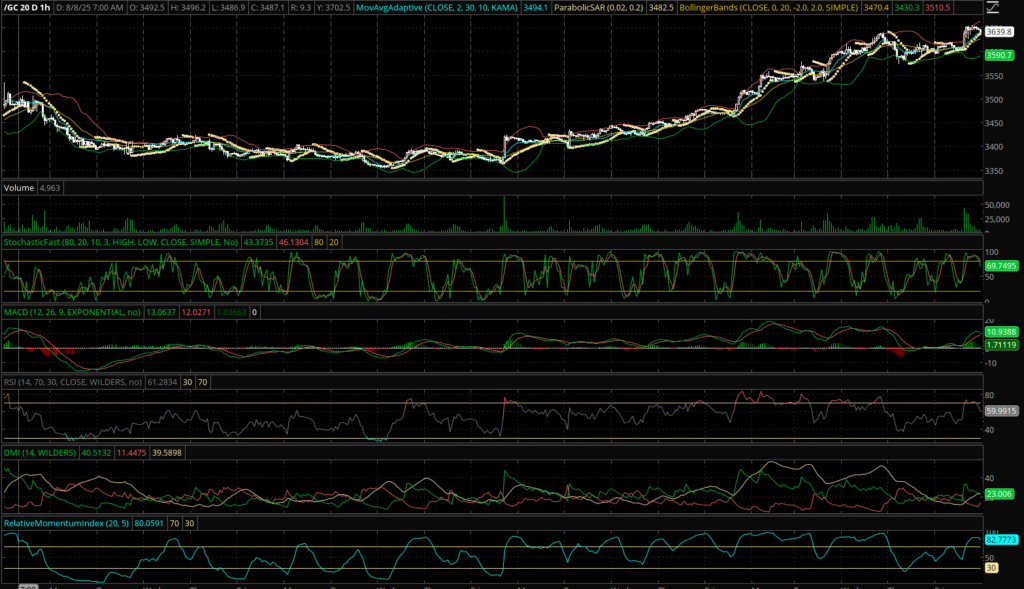

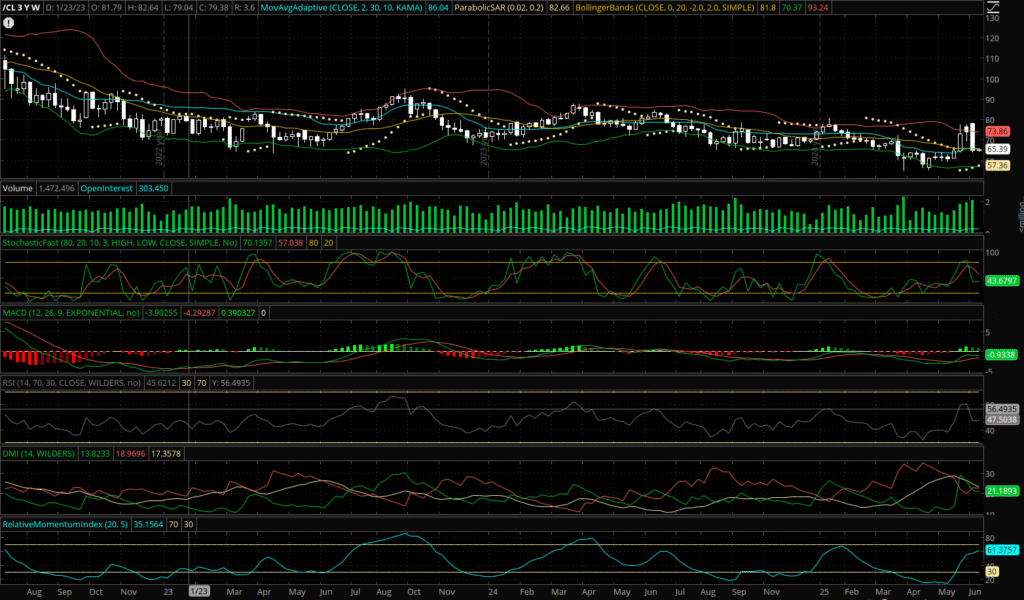

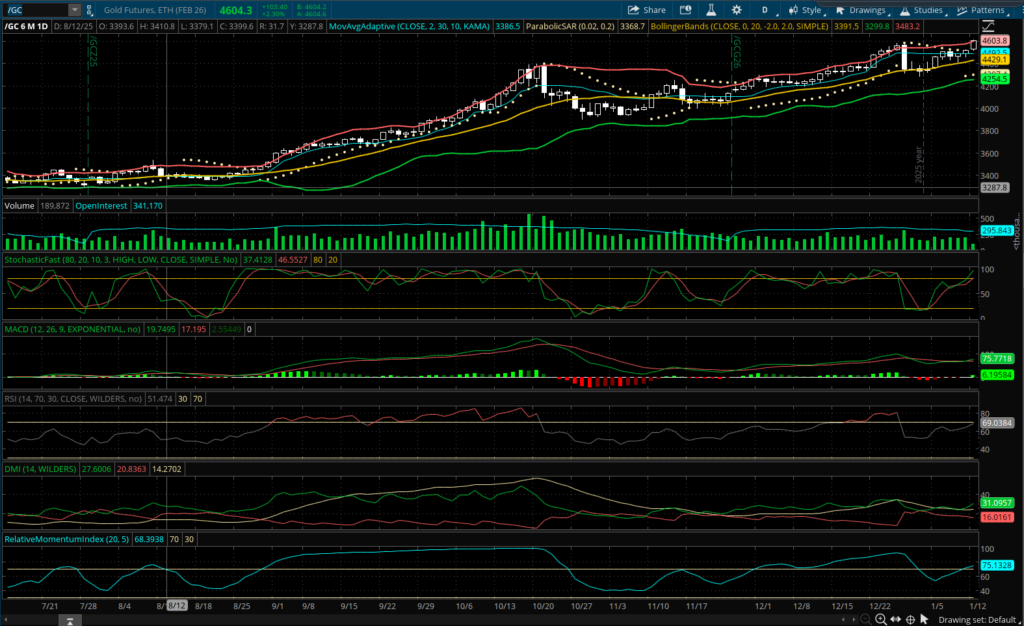

Precious metals continue to be extremely active. This is also a sign that market participants are expecting further turbulence, primarily resulting from the actions of Donald Trump.

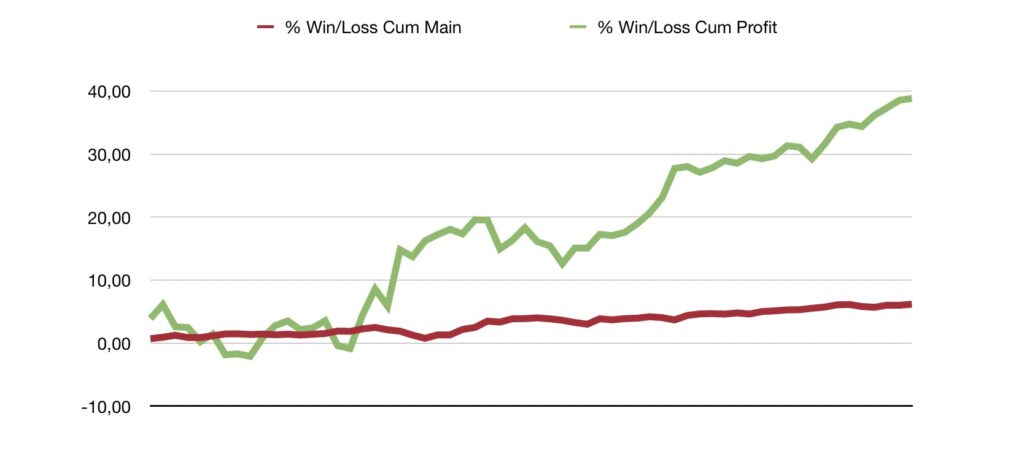

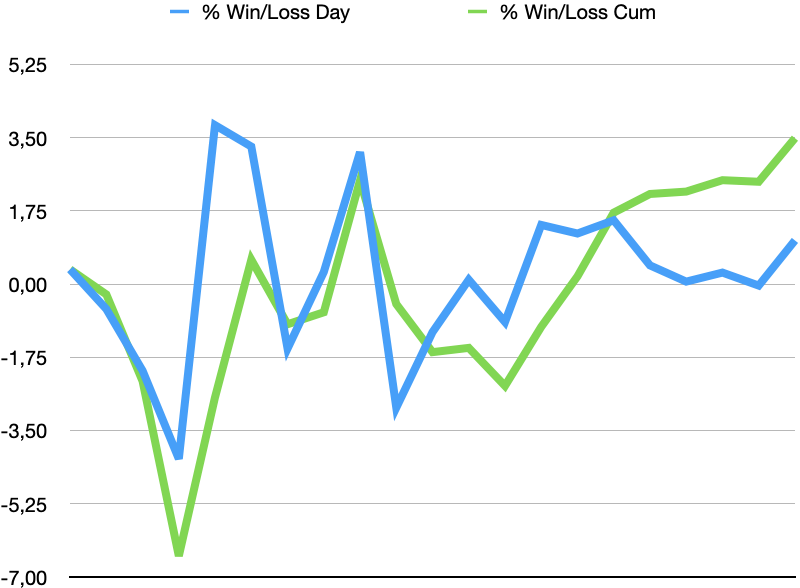

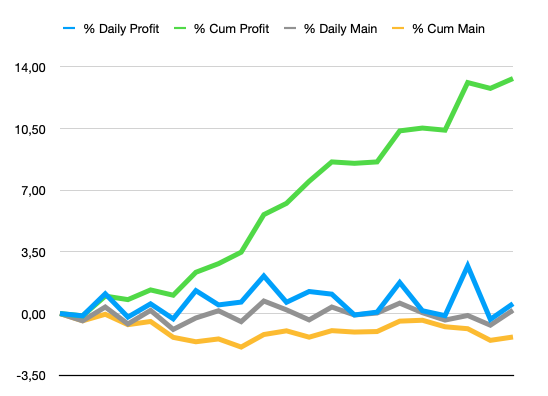

The markets remain exciting, and with the right touch, significant profits can be made.